Hsa Contribution Limits 2025 Irs Over Age 65. Let’s explore the contribution limits for 2025: Given these criteria, exploring the nuances of hsas and medicare can uncover strategies for advisors to help their clients over age 65 maximize their hsa.

Individual hdhp minimum deductible for 2025: As this article discusses, individuals who enroll in medicare part a are not allowed to continue funding their hsa, and anyone postponing medicare enrollment must be diligent about how applying.

Hsa Contribution Limits In 2025 Tanya Eulalie, Given these criteria, exploring the nuances of hsas and medicare can uncover strategies for advisors to help their clients over age 65 maximize their hsa. Those age 55 and older can make an additional $1,000 catch.

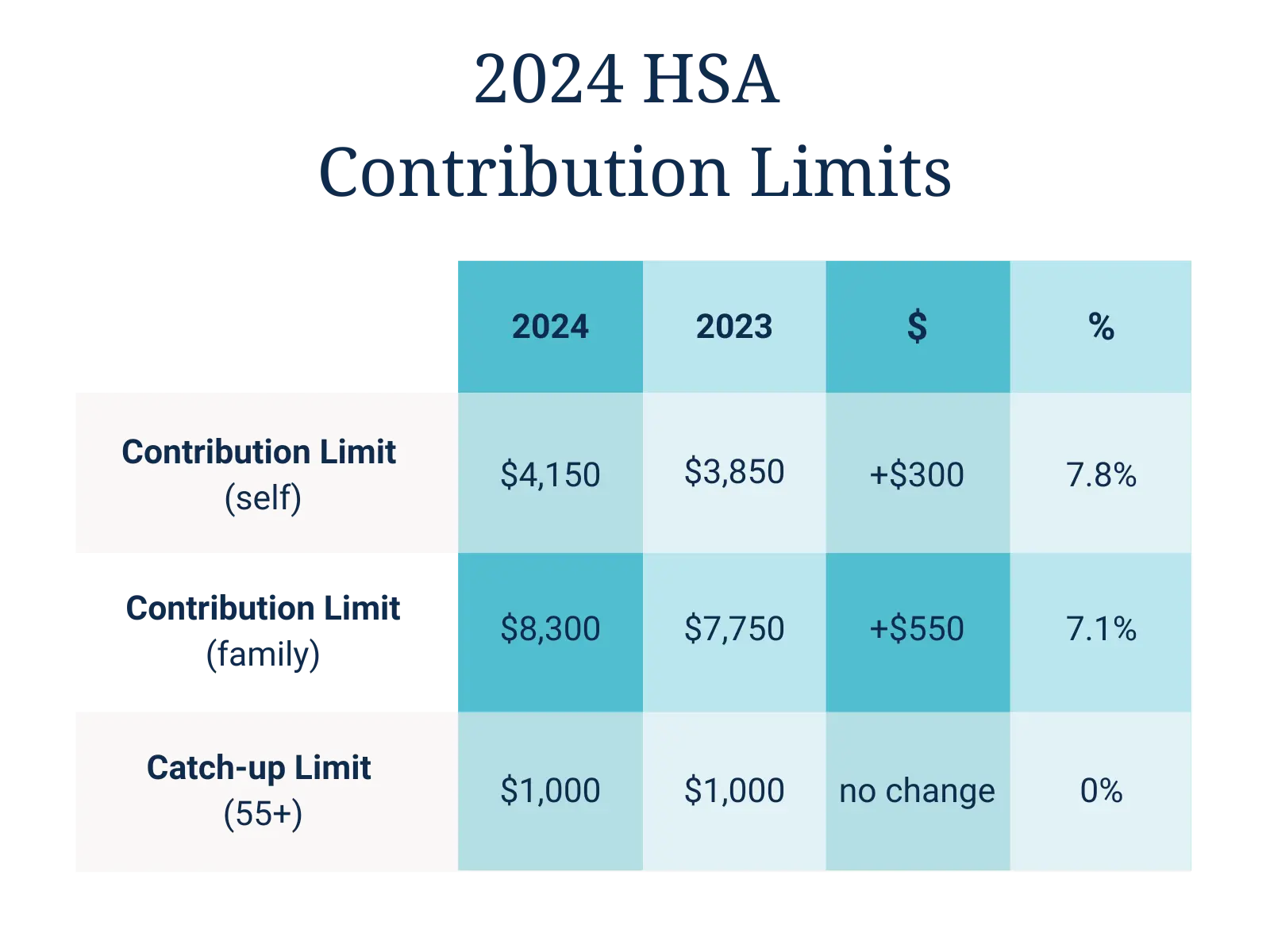

Hsa Contribution Limits For 2025 And 2025 Image to u, The hsa contribution limits for 2025 are $4,150 for individuals and $8,300 for families. Use this information as a reference, but please.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, Your contribution limit increases by $1,000 if you’re 55 or older. Once you’re enrolled in medicare and over age 65, hsa savings can be used to pay premiums for medicare.

Federal Hsa Limits 2025 Renie Delcine, In 2025, individuals can contribute $4,150 and families can. This compliance overview summarizes key features for hsas, including the contribution limits for 2025.

Irs Hsa Catch Up Contribution Limits 2025 Mandy Kissiah, The 2025 contribution limit is $4,150 for. Your contribution limit increases by $1,000 if you’re 55 or older.

Hsa Family Limit 2025 Over 55 Esta Alexandra, In 2025, individuals can contribute $4,150 and families can. Those age 55 and older can make an additional $1,000 catch.

Irs Hsa 2025 Shara Delphine, Let’s explore the contribution limits for 2025: 2025 hsa contribution limits 2025 over 65.

Hsa Maximum 2025 Family Contribution Melly Leoline, The maximum contribution for family coverage is $8,300. If you want to put more money in an hsa this year, make sure you don’t exceed the applicable contribution limit.

401k Contribution Limits 2025 Over 50 Years Becka Carmita, The 2025 hsa contribution limit for individual coverage increases by $300 to $4,150. Individual hdhp minimum deductible for 2025:

Hsa Yearly Contribution Limit 2025 Perle Brandice, The maximum contribution for family coverage is $8,300. Those age 55 and older can make an additional $1,000 catch.