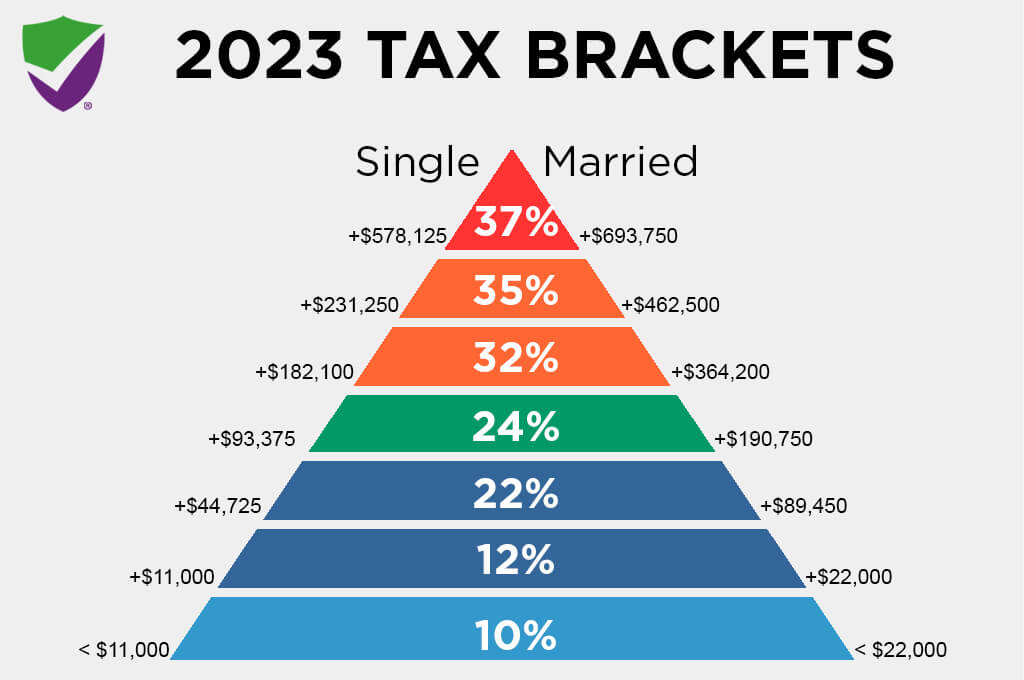

Irs Tax Rates 2025 Tax Brackets. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

10%, 15%, 25%, 28%, 33%, 35%, and 39.6%. Are you wondering what the 2025 federal tax income brackets are, and where you land on the irs tax table?

Irs Tax Brackets 2025 Chart Printable Free Jilli Lurleen, Based on your annual taxable income and filing status, your tax bracket determines your federal tax rate.

2025 Tax Brackets And Rates carlyn madeleine, Tax system, income tax rates are graduated, so you pay different rates on different amounts of taxable income.

2025 Standard Deductions And Tax Brackets Rayna Delinda, From 2018, the new bracket rates are 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

2025 Federal Tax Brackets Chart Dynah Christye, The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single.

What Is The Tax Bracket For 2025 Bella Carolee, You pay tax as a percentage of your income in layers called tax brackets.

What'S The Tax Brackets For 2025 Ynez Analise, The irs uses 7 brackets to calculate your tax bill based on your income and filing status.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, These adjustments are made annually to account for inflation and

2025 Tax Brackets And Rates carlyn madeleine, The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single.